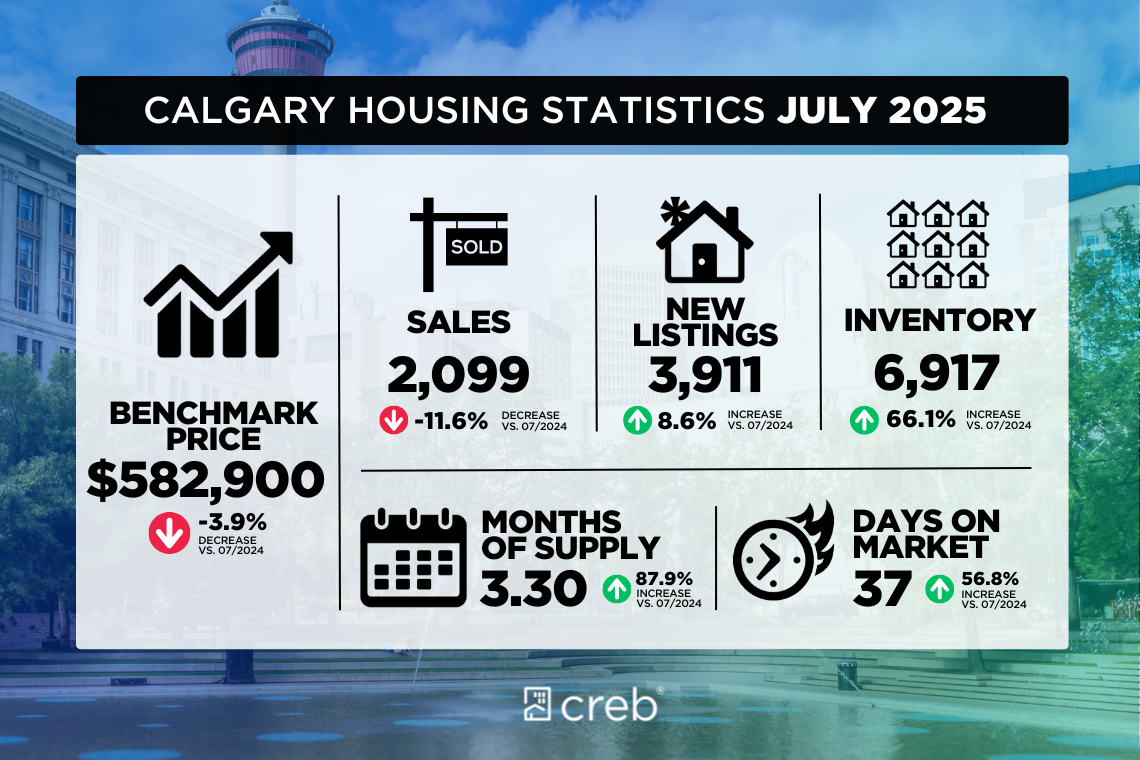

Supply growth weighs on home prices

Thanks to gains mostly occurring in the newer communities, inventory levels in July were 6,917 units, reaching levels not seen since prior to the pandemic and higher than long-term trends. While supply has improved across all property types and all districts, the largest gains are occurring in the areas where there has been new community growth.The additional supply has weighed on home prices in some parts of the city. The total residential benchmark price in Calgary has trended down over the past several months and is currently four per cent below last year’s peak price reported in June 2024.

“Price declines are not occurring across all property types in all locations of the city, and even where there have been declines, it has not erased all the gains made over the past several years,” said Ann-Marie Lurie, Chief Economist at CREB®. “The steepest price declines have occurred for apartment and row style homes, mostly in the North East and North districts, which coincides with significant gains in new supply.”

The rise in supply occurred as sales continued to slow and new listings improved. In July, there were 2,099 sales, a 12 per cent decline over last year, while new listings reached 3,911 units, an over eight per cent increase over last year. In addition to the persistent economic uncertainty due to tariffs, sales and new listings were impacted by no further reductions in lending rates and added competition from the new home market. Apartment-style homes are reporting the highest months of supply with over four months, while both detached and semi-detached homes are seeing conditions remain relatively balanced at just three months of supply.

Detached

For the first time since 2020, the months of supply for detached homes rose to three months. Sales activity slowed to 1,031 units in July, while the number of new listings, despite being slower than last month, was still nearly 10 per cent higher than last year’s levels and above long-term trends. The wider gap between sales and new listings led to a significant adjustment in inventory levels and, with slower sales, the months of supply rose to three months.However, conditions did vary significantly depending on location. In the North West, West and South districts, the months of supply remained well below three months, whereas the North East reported the highest months of supply at over four months.

A shift to balanced conditions has taken much of the pressure off home prices. As of July, the detached benchmark price was $761,800, down less than one per cent over last year. However, there was a significant range of price adjustments. Both the North East and East districts have reported the largest decline in price at five per cent, though prices still rose in the City Centre by nearly two per cent.

Semi-Detached

Sales activity in July continued to slow, contributing to the year-to-date decline of 11 per cent. At the same time, new listings have generally been higher this year compared to last year, supporting inventory gains. With 549 units in inventory and 187 sales, the months of supply in July rose to three months, something that has not happened since 2021.Although supply is improving in relation to sales, prices have remained relatively stable. As of July, the benchmark price in the city was $697,500, one per cent higher than last July. Price growth did range throughout each district, with the highest gains occurring in the City Centre, with nearly three per cent growth. Meanwhile, prices declined over last year in the North East, East and North districts.

Row

Like other styles of homes, sales have eased compared to last year, with new listings and inventories rising over last July. The months of supply in July was similar to last month at over three months, with a range of under three months of supply in the City Centre, North West , South and South East, to nearly five months of supply in the North East district.Row prices have generally been trending down over the past three months, and while they are nearly four per cent lower than last year at this time, on a year-to-date basis they have remained similar to last year. When considering activity by district, year-to-date price declines have been reported in the North East and North, while prices have risen in all other districts.

Apartment Condominium

There were 1,014 new listings in July relative to 508 sales, keeping the sales-to-new listings ratio at 50 per cent and inventory levels elevated at 2,097 units. Higher inventories and slower sales caused the months of supply to push above four months in July, the highest it has been since 2021. Added competition for new product combined with rising rental vacancy rates has impacted the resale condominium market.The additional supply choice is having a more significant impact on apartment style prices over any other property type. In July, the benchmark price was $329,600, which is down over one per cent compared to last month and nearly five per cent lower than levels reported last year. However, when considering year-to-date figures, prices have remained stable compared to last year as gains in the West, South and North West have offset declines occurring in the North East, North, South East and East districts.